Principles-based framework

Published

Last updated

The Parliamentary Business Resources framework (PBR framework) is the principles-based framework governing parliamentarians' work expenses.

The PBR framework is made up of the:

- Parliamentary Business Resources Act 2017 (PBR Act)

- Parliamentary Business Resources Regulations 2017 (PBR Regulations)

- Determinations made under the PBR Act.

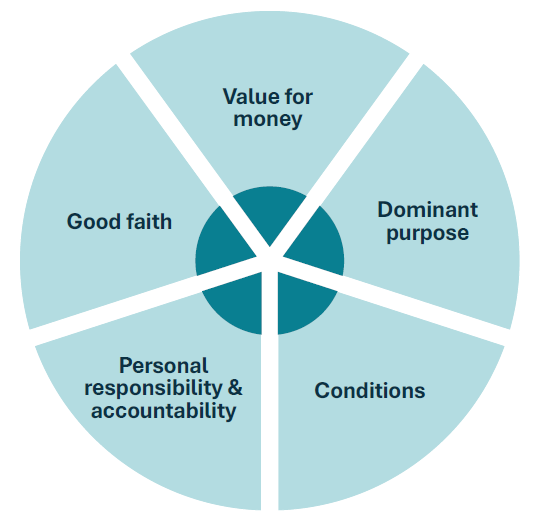

Under the PBR framework, parliamentarians must ensure that work expenses for parliamentary business are consistent with the obligations under the PBR Act:

- value for money

- dominant purpose

- conditions

- good faith

- personal responsibility and accountability.

Obligations

The introduction of a principles-based approach, and the establishment of a legal framework to govern the use of public resources for parliamentary business are important reforms to parliamentarians' work and travel expenses, implemented on 1 January 2018.

Parliamentarians must ensure that expenditure accessed for parliamentary business is consistent with the obligations outlined in the table below.

| Obligation | From 1 January 2018 |

|---|---|

| Dominant purpose | Parliamentarians must ensure that any expenses incurred are for the dominant purpose of conducting parliamentary business. Parliamentarians should consider whether they would have undertaken an activity which involved the incurring of an expense even if there was no parliamentary business related to the activity. |

| Value for money | The expenses framework also requires that parliamentarians' use public resources for parliamentary business in a way that achieves value for money. Value for money means using public money efficiently, effectively and economically, consistent with the obligations on the proper use of public resources by Commonwealth officials under the Public Governance, Performance and Accountability Act 2013. |

| Good faith | Parliamentarians need to act ethically and in good faith when using, or accounting for, public resources. For example, they must not seek to disguise their personal or commercial business as parliamentary business. Acting in good faith requires that parliamentarians act honestly and consider all of the reasons for claiming or using public resources in the circumstances. |

| Personal responsibility and accountability | A parliamentarian is personally responsible and accountable for their use of public resources and should consider how the public would perceive their use of these resources for travel in particular circumstances. Personal responsibility extends to the use of public resources in the parliamentarians' name by others who may be authorised to incur expenses within their office, or for family reunion purposes. A parliamentarian must be prepared to publicly justify their use of public resources and should consider how the public would perceive their use of public resources for travel in particular circumstances. |

| Conditions | A parliamentarian must not make a claim, or incur an expense, in relation to a public resource if they have not met ALL of the conditions for its provision. Conditions may include imposed limits and can be specific to individual work expenses. They are set out in the PBR Regulations and in Determinations of the Remuneration Tribunal and the Special Minister of State. |

More information

- Additional information on the principles-based framework can be found on the Legislative Framework page.

- For travel related queries or advice, please contact IPEA on (02) 6215 3000 or by email to enquiries@ipea.gov.au.

- For queries or advice on all non-travel related work expense matters, please contact Ministerial and Parliamentary Services on (02) 6215 3333 or by email to mpshelp@finance.gov.au.

Related content

View information on parliamentarians' travel under the parliamentary business resources (PBR) framework

A parliamentarian travelling within Australia on parliamentary business may be accompanied or joined by their spouse or nominee, dependent child(ren) and designated person(s) at Commonwealth expense.

IPEA provides advice to parliamentarians, their staff, and former parliamentarians about the use of parliamentary travel resources